Micro Credit Management Software Free Download

Download this Loan Management System script for free at Glob Intel Our Loan Manager is an online credit administration framework that enables loaning organizations to deal with their borrowers, advances, reimbursements, and accumulations efficiently while being moderate in the meantime. Microfinance free download - Microfinance), MicroFinance, NBFC, Credit Co-Op Society and Nidhi, Savings Plus, and many more programs. Thanks for downloading the Business Credit Master app. Business Credit Masters wants to help you get the money you need to meet your business goals. Get the money you need today without paying huge financing fees. Providing an affordable way for any individual or business with good credit to receive $50,000 – $250,000 at 12%, on the back-end.

End-to-End Solution

HES FinTech software for MFI lenders covers end-to-end functionality in a single system: origination, underwriting, servicing, collection, and reporting. Speed up “time-to-fund” and discard insecure manual processes in favor of smooth automated workflows.

Whether you need to go digital, add process automation, or facilitate the transformation of current operations, our microfinance system can meet your business needs in an ever-changing lending market.

Origination

Micro Credit Management software, free download 2012

Orchestrate the loan origination process with a dedicated end-to-end solution. Save labour and other operating costs. Accelerate the speed of loan application handling from first engagement with a borrower to the final acceptance.

Free Credit Repair Software Download

- — Smooth application process

- — Verification of the customers’ identity and compliance

- — Quick credit risk assessment with AI

- — Automatic processing of documents/loan underwriting

Servicing

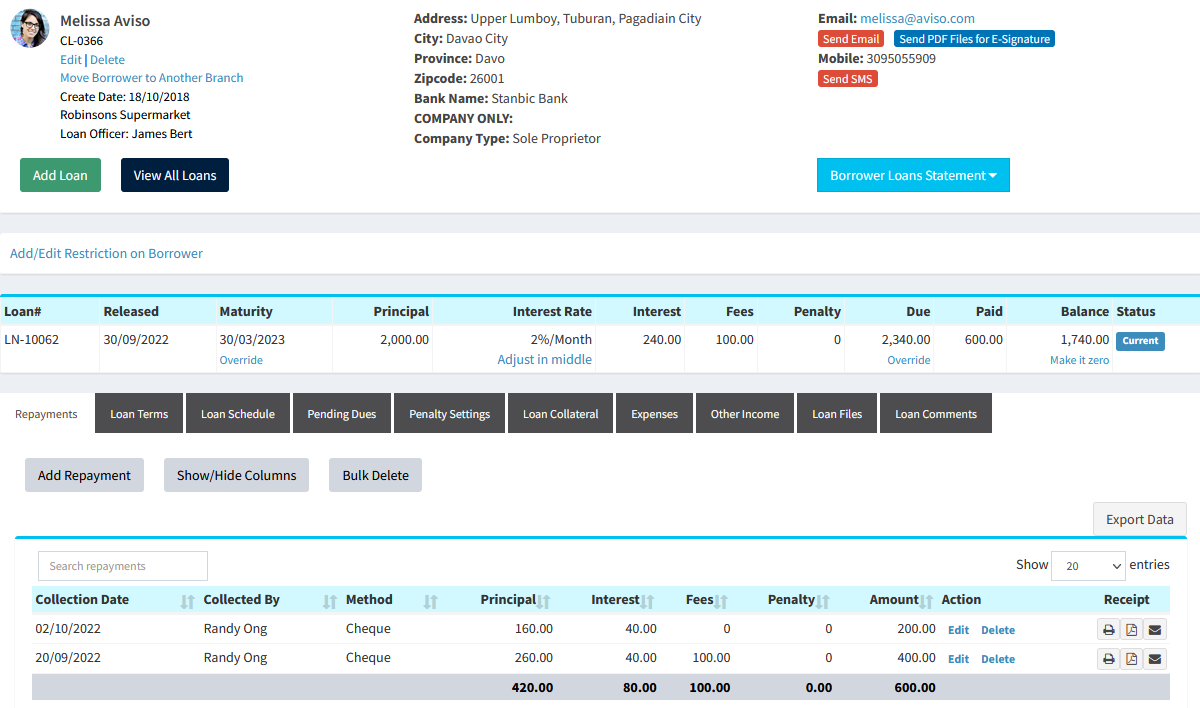

HES software replaces siloed servicing and provides full control over the process. Automate every single step after disbursing the funds until the loan is fully paid off. Сollect principal, interest, and escrow payments from a borrower. Monitor delinquencies, restructurings and execute foreclosures.

- — Loan disbursement automation

- — Payment schedules management

- — Daily calculations for accruals, arrears, write-offs

Credit Scoring

Determine the creditworthiness of borrowers at speed and scale. Integrate with third-party credit scoring providers or build your own scoring system and make well-informed credit decisions.

- — Accurately assess the financial state of borrowers

- — Automatically build, validate and deploy AI scoring models

- — Reduce NPLs and boost loan portfolio return

Statistics & Reporting

The reporting module provides fast, customizable access to interactive dashboards with accurate information and easy-to-use tools to make critical business decisions. Instant reports allow MFIs to track areas that need immediate attention.

Export data to a range of formats, use clear standard dashboards or create comprehensive reports and deliver results to the right person in the right format.